Renters Insurance in and around Columbia

Welcome, home & apartment renters of Columbia!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Columbia

- Ellicott city

- Elkridge

- Laurel

- Baltimore

- Catonsville

- Severn

- Odenton

- Owings Mills

- Reisterstown

- Annapolis

- Frederick

- Rockville

- Bethesda

- Wheaton

- Silver spring

- Essex

- Towson

- Burtonsville

- Howard County

- Anne Arundel County

- Baltimore County

- Montgomery County

Insure What You Own While You Lease A Home

It may feel like a lot to think through your sand volleyball league, work, family events, as well as coverage options and deductibles for renters insurance. State Farm offers straightforward assistance and impressive coverage for your home gadgets, pictures and sound equipment in your rented townhome. When trouble knocks on your door, State Farm can help.

Welcome, home & apartment renters of Columbia!

Rent wisely with insurance from State Farm

State Farm Has Options For Your Renters Insurance Needs

Renters often raise the question: Do you really need renters insurance? Imagine for a minute the cost of replacing your stuff, or even just one high-cost item. With a State Farm renters policy by your side, you won't be slowed down by fires or break-ins. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've placed in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Dave Lerer can help you add identity theft coverage with monitoring alerts and providing support.

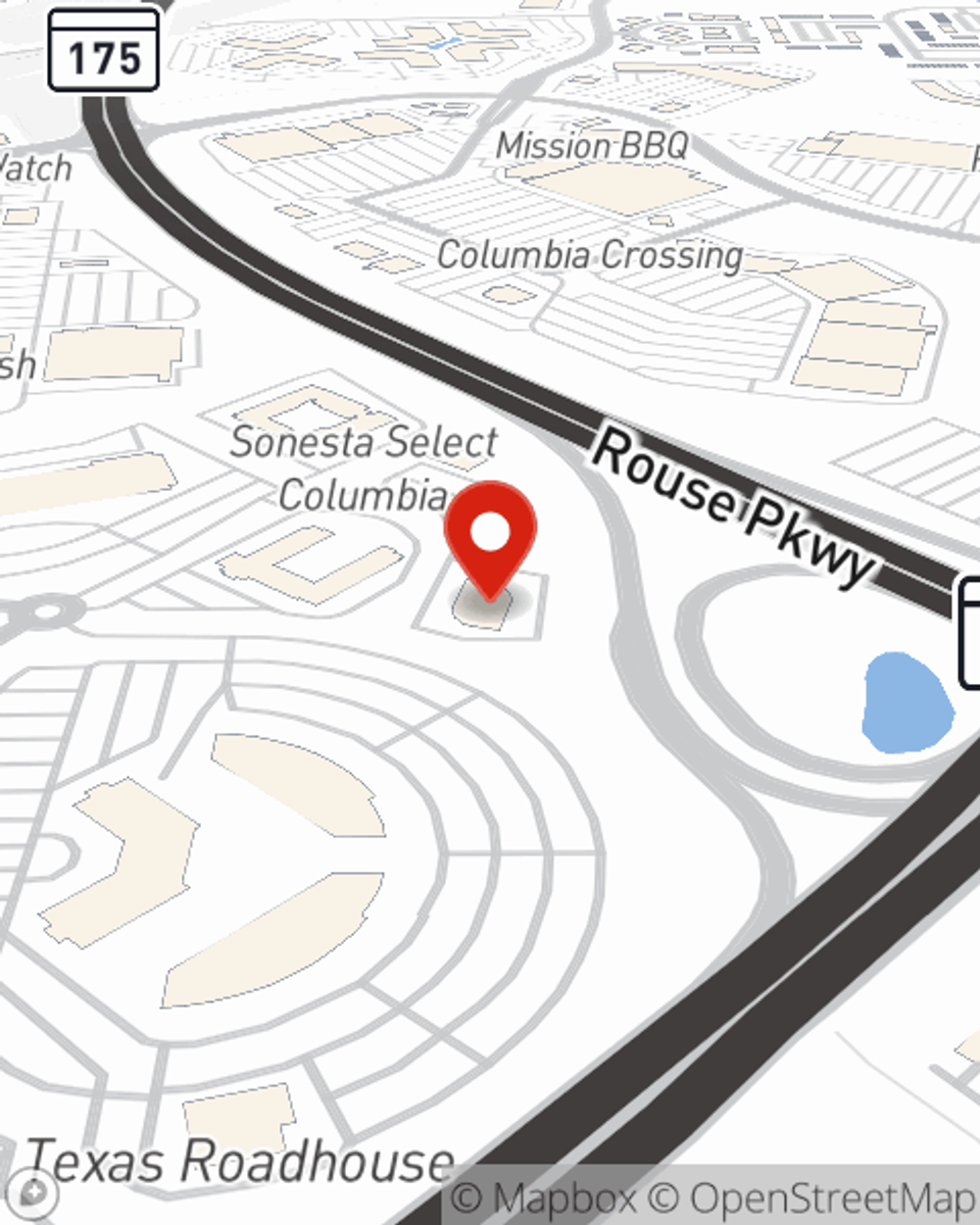

State Farm is a reliable provider of renters insurance in your neighborhood, Columbia. Contact agent Dave Lerer today for help with all your renters insurance needs!

Have More Questions About Renters Insurance?

Call Dave at (410) 953-8100 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.