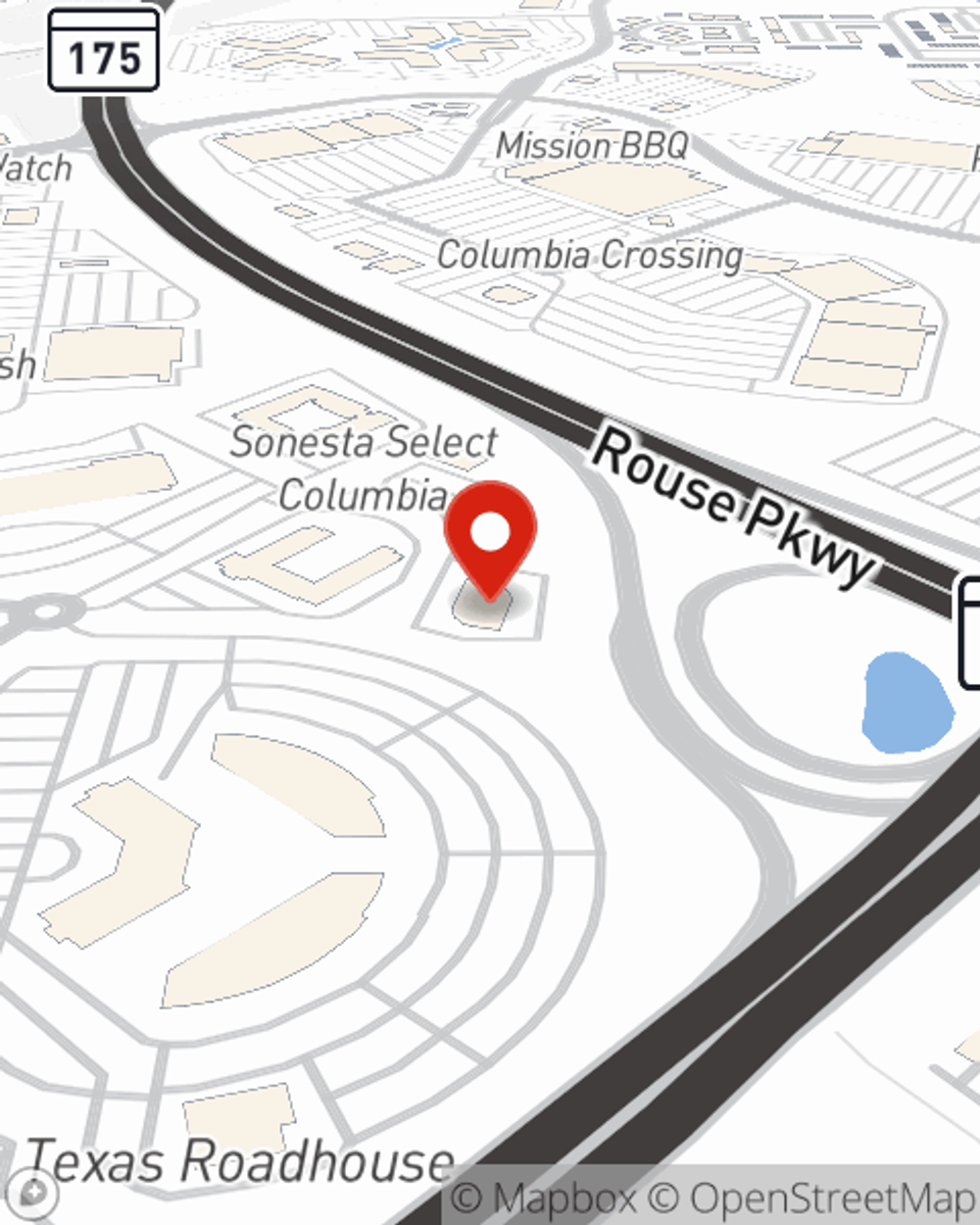

Business Insurance in and around Columbia

One of the top small business insurance companies in Columbia, and beyond.

Insure your business, intentionally

- Columbia

- Ellicott city

- Elkridge

- Laurel

- Baltimore

- Catonsville

- Severn

- Odenton

- Owings Mills

- Reisterstown

- Annapolis

- Frederick

- Rockville

- Bethesda

- Wheaton

- Silver spring

- Essex

- Towson

- Burtonsville

- Howard County

- Anne Arundel County

- Baltimore County

- Montgomery County

State Farm Understands Small Businesses.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like worker's compensation for your employees, extra liability coverage and a surety or fidelity bond, you can feel confident that your small business is properly protected.

One of the top small business insurance companies in Columbia, and beyond.

Insure your business, intentionally

Keep Your Business Secure

Your company is unique. It's where you earn a living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a facility or an office. Your business is your life's work. Doing what you can to keep it safe just makes sense! That's why one of the most sensible steps is to get outstanding small business insurance from State Farm. Small business insurance covers a wide range of occupations like a real estate agent. State Farm agent Dave Lerer is ready to help review coverages that fit your business needs. Whether you are a veterinarian, a hair stylist or an HVAC contractor, or your business is a pizza parlor, an acting school or a bicycle shop. Whatever your do, your State Farm agent can help because our agents are business owners too! Dave Lerer understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Ready to talk through the business insurance options that may be right for you? Get in touch with agent Dave Lerer's office to get started!

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Dave Lerer

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.